NACH full form in Banking is National Automated Clearing House. The NACH payment system is like a central hub for moving money electronically in India. It is managed and controlled by the National Payments Corporation of India (NPCI), which is overseen by the Reserve Bank of India (RBI).

NACH makes it easy and safe to handle large payments and transfer money electronically within India. It simplifies the process by using computers to automatically handle the clearing and settlement of transactions, which means less paperwork and less need for people to get involved manually.

Features of NACH payment system

- High volume Interbank electronic transactions, repetitive and periodic in nature

- Consolidates Multiple ECS (Electronic Clearing System) running previously and standardised the electronic money transfer in India

- Facilitates Aadhaar Based Transfer using Aadhaar and bank account number

- Facilitates both Debit and Credit Transactions:

- a) Debit NACH Transactions – Loan EMIs, Mutual Funds, Utility bills etc

- b) Credit NACH Transactions – Government subsidies, Salaries, Dividend, Direct Benefit Transfers etc

- Mandate Management System (MMS) and Dispute Management System (DMS)

- Can set-up mandate through paper based or e-mandate

- Corporate clients can also directly upload files for approval (Direct Corporate Access)

Participants in NACH payment system

- Corporates – Any Employer, Biller, Utility service provider etc.

- Sponsor Banks – Initiates a debit or a credit transactions on behalf of Corporates.

- NPCI – Regulates and handles NACH

- Destinations Banks – Customer’s Bank from where the amount is debited in case of biller and credited in case employers.

- Customer – Who actually pays amount for the services or receives amount from employer

NACH Mandate Management System

The NACH Mandate Management System is an electronic payment system that is used in India. It is managed by the National Payments Corporation of India (NPCI). This system allows businesses and organizations to easily collect payments from their customers or make regular payments to their vendors. It is a safe and efficient platform for handling large numbers of debit and credit transactions.

- Registration: The first step is to register both the sponsoring bank (the bank initiating transactions) and the destination bank (where the beneficiary holds an account) with the NPCI.

- Mandate Setup: Necessary information is collected by sponsoring bank from customers/vendors, such as bank account details and authorization for recurring payments. Mandate is created with these information, which are instructions given by customers to allow the sponsoring bank to debit or credit their accounts.

- Mandate Submission: The sponsoring bank submits the mandates to the NPCI’s NACH platform for verification and further processing of these mandates.

- Mandate Verification: The NPCI checks the submitted mandates to ensure their accuracy and compliance with the specified format and rules. This helps prevent errors and fraudulent activities.

- Mandate Approval: Verified mandates are approved by NPCI approves them and assigns a unique mandate registration reference number (MRRN) to each mandate.

- Transaction Processing: Transactions are initiated by the sponsoring bank once mandates are approved based on the authorized mandates. These transactions can be debit transactions (e.g., collecting payments from customers) or credit transactions (e.g., making vendor payments). The NPCI processes these transactions and facilitates the transfer of funds between the sponsoring bank and the destination bank.

- Settlement: Reconciliation and settlement of the funds between the sponsoring bank and the destination bank based on the processed transactions is done by NPCI. Settlement usually occurs at predefined intervals, such as daily or periodically, depending on the agreement between the participating banks.

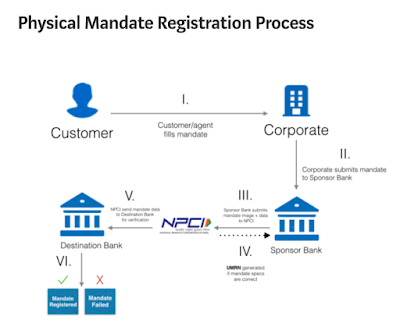

Physical NACH Mandate Registration

Here’s an overview of the physical NACH mandate registration process:

- Mandate Form: The customer fills out the mandate form with accurate and complete information as required like customer’s bank account details, authorization for recurring payments, and other necessary information.

- Submission: Signed physical mandate form is submitted to the sponsoring bank. This can be done either by personally visiting the bank branch or by sending the form through postal mail or courier service.

- Verification: The sponsoring bank verifies the physical mandate form to ensure its completeness, accuracy, and compliance with the specified requirements.

- Processing and Activation: Upon verifying the physical mandate form, the sponsoring bank enters the details into the NACH system, connecting it to the customer’s bank account. This enables recurring payments or credits as per authorized mandates, facilitating automatic transactions based on agreed terms.

Image Source: Digio

eMandate NACH Registration

Here’s an overview of the physical NACH mandate registration process:

- Fill eMandate Form: Fill out the eMandate form online, providing bank account details and authorization for recurring payments or credits.

- Submit Online: Submit the eMandate form through the designated online platform or banking portal.

- Verification: The sponsoring bank verifies the eMandate details for accuracy and compliance.

- Approval: Once verified, the eMandate is approved, allowing for automatic transactions as per authorized mandates.

- Transaction Enablement: The customer’s bank account is now ready for recurring payments or credits through the NACH system.

Image Source: Digio

ACH, NACH, eMandate, eNACH, ACH Mandate

ACH and NACH are electronic funds transfer systems used in the United States and India, respectively. eNach and eMandate are processes that involve the electronic authorization of recurring payments, with eNACH specifically being used within the NACH system in India. ACH Mandate refers to the authorization process specific to the ACH system in the United States.

| Term | Definition | Usage | Regulation |

|---|---|---|---|

| ACH | Electronic funds transfer system primarily in the US | Various types of payments | Regulated by National Automated Clearing House Association (NACHA) |

| NACH | Indian payment system based on the ACH model | Electronic fund transfers within India | Regulated by National Payments Corporation of India (NPCI) |

| eMandate | Electronic authorization process for recurring payments | Authorizing recurring payments | Used in India for various recurring payments |

| eNACH | Electronic mandate process within the NACH system | Integrating eMandate with NACH | Used in India within the NACH system |

| ACH Mandate | Authorization process specific to the ACH system | Authorizing recurring payments | Used in the United States with the ACH system |