Is your Credit card not eligible for a 1+1 free movie ticket? Do you know why?

It’s because your credit card BIN is not eligible for this offer. Now what is BIN!

Let me help you understand.

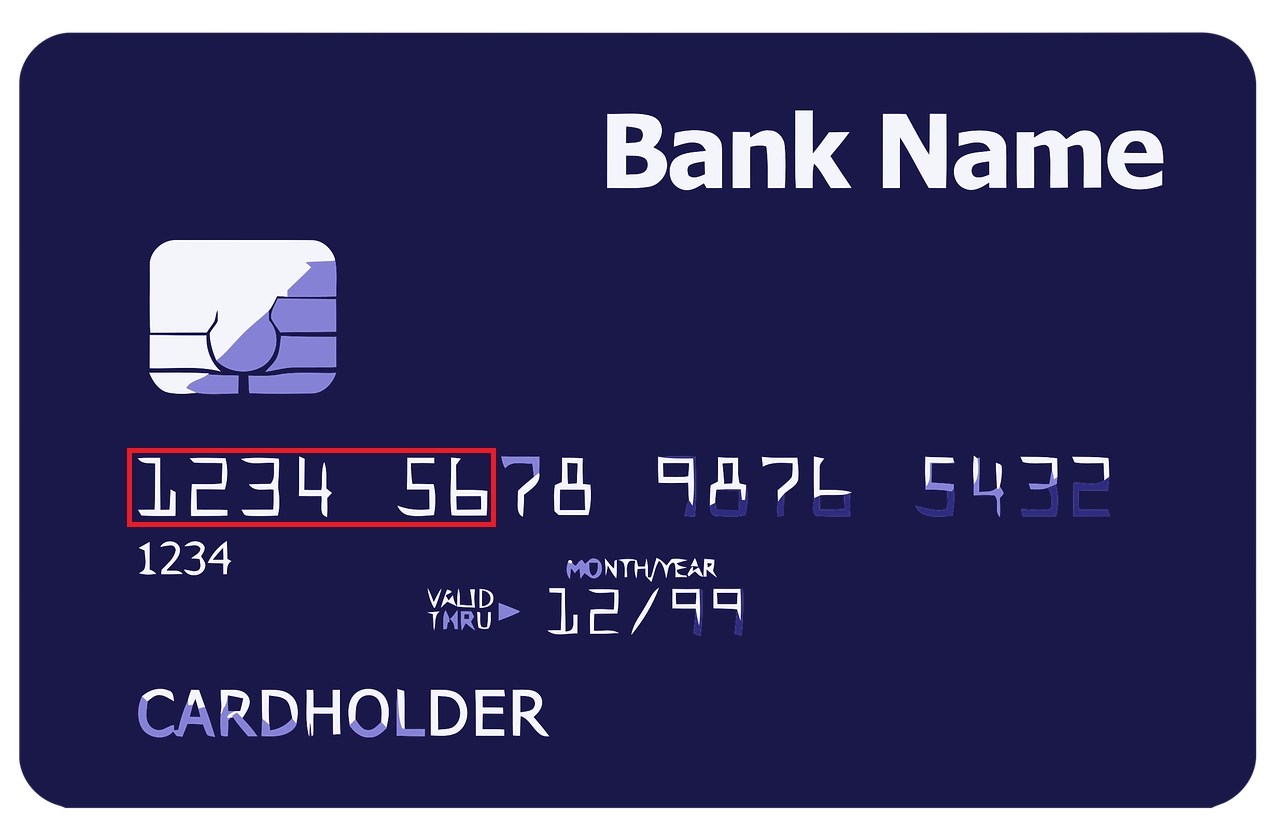

What is Card BIN – Every time a customer makes a purchase using their credit or debit card, the card issuer utilises a unique code called a Card BIN (Bank Identification Number) to authenticate and identify the transaction.

The Card BIN consists of the first six digits of a card number, assigned by the card network to the card issuer. The first digit in a BIN is called the major industry identifier (MII). Cards that belong to the Visa payment network often start with a 4, for instance, and cards that belong to the Mastercard payment network usually start with a 2 or 5. The remaining BIN digits identify a card’s issuer.

Card organisations Visa and Mastercard has extend the BIN (Bank Identification Number) of their cards from 6 to 8 digits globally on April 1st 2022. The massive growth of credit card issuers in recent years has led to change.

Benefits of Card BIN:

Card Fraud Detection and Prevention – Card BIN numbers play a crucial role in preventing fraudulent activities by verifying the validity of a card and lowering the possibility of chargebacks. To identify suspicious activities, card issuers utilise algorithms that scrutinise transaction patterns and highlight any unusual behaviour.

Card Offer Configuration – Card BINs are used to configure card offers on eligible cards. For e.g, If Brand “B” wants to run a cashback offer on the credit cards of Issuer “I” then cashback will only be processed on the successful transaction of cards with BIN of “I”.

Chargeback Prevention – Chargebacks occur when a cardholder disputes a transaction and requests a refund from the card issuer. They can be costly and time-consuming for merchants, damaging their reputation with payment processors. By using Card BIN numbers, merchants can verify the card’s validity and ensure that the cardholder is the authorised user, minimising the likelihood of chargebacks.

Faster Card Processing – The use of Card BIN numbers reduces the chances of declined transactions, leading to faster processing times. This allows merchants to quickly verify the card’s validity and available funds before proceeding with the transaction, resulting in a decreased risk of declined transactions.

Improved Customer Experience – Using Card BIN numbers can enhance the customer experience by minimising the probability of declined transactions and chargebacks. A declined card or unauthorised transaction can cause frustration and dissatisfaction. By using Card BIN numbers to authenticate transactions, merchants can ensure that only authorised transactions are processed, improving the customer experience and increasing customer loyalty.

Enhanced Security – Using Card BIN numbers can boost the security of card transactions by reducing the risk of fraud and chargebacks. Card issuers utilise sophisticated algorithms to analyse transaction patterns and identify suspicious activities. By using Card BIN numbers to verify the card’s validity, merchants can ensure that only authorised transactions are processed, minimising the risk of fraudulent activities.

Conclusion:

Card BIN numbers are critical for businesses that accept card payments. They provide several benefits, including fraud detection and prevention, chargeback prevention, faster processing times, improved customer experience, and enhanced security. By using Card BIN numbers to verify the card’s validity and ensuring that only authorised transactions are processed, merchants can reduce the risk of fraudulent activities, improve processing times, and enhance the customer experience.